Tag: project

What is Interest Rate and What Will I Pay?

When you’re looking at new build homes, whether it’s your first time or you’re an experienced buyer, one term you’ll hear a lot is “interest rate.” But what exactly is an interest rate, and how does it impact what you pay each month?

What Are Interest Rates and How Do They Work?

In simple terms, an interest rate is the cost of borrowing money. When you take out a mortgage or any personal loan, you’re not just paying back the amount you borrowed (called the principal); you’re also paying interest, which is a percentage of the loan. The interest is essentially the fee lenders charge for lending you the money.

For example, if you’re buying a new home and take out a mortgage of £200,000, the interest rate on that loan determines how much extra you pay on top of the £200,000. Over time, that can add up, so even a small change in interest rates can make a big difference in your monthly repayments.

What Factors Impact Your Mortgage Payments?

Interest rates can vary depending on a few key factors. One big influencer is inflation, which refers to the general rise in prices for goods and services, often measured by the Consumer Prices Index (CPI). When inflation goes up, interest rates tend to follow, making borrowing money more expensive. This means if you’re applying for a mortgage during a time when consumer prices are on the rise, you might have to pay more in interest.

Your credit score and credit history also play a significant role. If you have a strong credit score, lenders are more likely to offer you a lower interest rate, as you’re seen as less risky. On the other hand, if your credit history isn’t great, you might find yourself facing higher interest payments.

Inflation and Interest Rates: What’s the Connection?

Inflation is closely watched by the Financial Conduct Authority and central banks. They use interest rates as a tool to control inflation. If inflation is rising too fast, interest rates may be increased to help slow it down by making borrowing more expensive. On the other hand, when inflation is low, interest rates might be cut to encourage spending and borrowing.

Since August 2024, inflation has been one of the primary concerns for both new home buyers and builders like George Martin. Prices rise for everything from materials to energy, which has a knock-on effect on house prices and the amount you’ll need to borrow. As a developer, we aim to build homes that are energy-efficient, which helps lower costs for you in the long run. However, understanding how inflation affects your mortgage can help you plan better.

Other Costs to Consider

Aside from interest rates and inflation, there are other costs that come with buying a new home. Stamp duty is one of them. Depending on the price of your home and whether you’re a first-time buyer, you may need to pay stamp duty, which is a tax on property purchases.

Then there’s the question of your loan term. If you choose a longer-term mortgage, your monthly payments will be lower, but you’ll pay more interest overall. Shorter-term loans mean higher monthly repayments but less interest paid over time.

When it comes to interest rates and mortgages, there’s no one-size-fits-all answer to how much you’ll pay. It depends on a variety of factors, including your credit score, inflation, and even the energy efficiency of the home you’re buying. However, by understanding the basics of interest rates and how they work, you’ll be better prepared to make informed decisions.

At George Martin, we work to ensure that every home we build is not only beautiful but also designed with your financial well-being in mind. From energy-efficient builds to expert advice on navigating the financial aspects of home buying, we’re here to help you every step of the way.

Reducing shrinkage in your new home

Moving into a new home is an exciting time, but it can also come with a few unexpected challenges. One of the most common issues homeowners face, especially with new builds, is shrinkage.

Shrinkage refers to the small cracks that appear in walls and floors as your home settles. While shrinkage is a natural part of the process, it can lead to more significant problems if left unchecked. Here’s how you can reduce shrinkage in your new build and protect your investment in the long term.

What's the cause?

Shrinkage occurs as building materials like plaster, wood, and concrete dry out. This is especially common in newly built houses, where the materials are still relatively fresh. As they lose moisture, they shrink, which can result in cracks. Water plays a big role in this process, as excess moisture can lead to a variety of damp problems, including mould growth, condensation problems, and even black mould.

Understanding the causes is the first step to reducing shrinkage. Controlling the moisture in your home is essential for preventing damp issues that could escalate over time.

Damp and Shrinkage: A Troubling Duo

While shrinkage itself is a natural process, excessive damp or moisture can exacerbate the problem. Damp can come from a variety of sources, including ground water, poor ventilation, and condensation. In older homes, damp problems might already be present, but new builds can also experience them if preventative measures aren’t taken.

To keep shrinkage and damp under control, make sure your home has proper ventilation. Installing an extractor fan in key areas like kitchens and bathrooms can help. This will reduce the humidity levels and prevent condensation problems, which can cause damp or mould to develop.

How to Reduce Shrinkage in Your New Home

There are several strategies you can use to reduce shrinkage and its effects in your new home. Here are a few practical tips:

- Control Humidity: New build houses tend to have higher levels of moisture as they dry out. Using dehumidifiers can help speed up this process and reduce the chances of shrinkage. This is particularly important in areas like basements, where damp problems are more common.

- Ventilation is Key: Proper airflow is essential for preventing condensation problems. Keep your home well-ventilated, especially in rooms that tend to collect moisture, like bathrooms and kitchens. An extractor fan can help pull moisture out of the air and reduce damp issues.

- Address Damp Problems Early: If you notice signs of damp, such as mould growth, wet walls, or condensation on windows, take action immediately. Damp proofing your home and using moisture barriers can help prevent further damage. Keep an eye out for black mould, which can be harmful to your health and indicates a serious damp issue.

- Dry Clothes Outside: Drying clothes indoors can lead to an increase in humidity levels, contributing to damp and condensation problems. Whenever possible, dry clothes outside or use a tumble dryer that vents outside.

- Check for Water Leaks: Inspect your home for any potential leaks, especially in areas prone to damp, such as under sinks, near windows, or around the roof. Even a small leak can lead to significant moisture build-up and increase the risk of shrinkage.

- Regular Inspections: A new home will settle over time, and small cracks may appear as part of the shrinkage process. Regular inspections will help you identify any problem areas before they worsen. Keep an eye on walls and floors for any signs of shrinkage or damp.

The Bottom Line: Shrinkage and Loss Prevention

The retail industry often talks about “shrinkage” in terms of loss prevention. In homes, reducing shrinkage is also about loss prevention—but in this case, it’s about preventing the loss of structural integrity in your new build. By following these tips, you can help minimize shrinkage, reduce damp problems, and maintain the quality of your home.

Whether you’re a first-time buyer or moving into a new build, keeping an eye on moisture levels is crucial. With proper damp proofing, regular ventilation, and attention to potential problem areas, you can enjoy your new home without the worry of shrinkage or damp issues.

For many first-time buyers, investing in a new home is a significant milestone. The last thing you want is to face expensive repairs down the line due to shrinkage or damp issues. These problems can not only affect the structural integrity of your home but can also lead to mould growth and other health risks. Taking the time to address these concerns early on can save you a lot of stress and money.

When looking at homes for sale, consider asking about the builder’s process for dealing with shrinkage and damp prevention. Understanding how the home was constructed and what measures have been taken to reduce moisture can give you peace of mind.

Beginners guide to: new build homes

Beginners guide to: New Build Homes

Embarking on the journey to buy a new build home can be both thrilling and daunting, especially for first-time buyers. With the rise of construction projects across the country, more people are leaning towards purchasing new build properties due to their modern amenities, energy efficiency, and the chance to personalize their space from the ground up.

This guide provides essential information and advice on finding the right new build home, booking viewings, and key considerations before making an offer.

Finding a New Build Home

The first step in buying a new build home is knowing where to look. Whether you’re searching for a local unit or exploring options through online shops, there are several ways to find a brand new home that suits your needs:

- Explore Home Developers: Start by visiting the websites of reputable home developers in your area. They often list new build properties, upcoming construction sites, and planned move-in dates. This can give you an early insight into available options.

- Local Citizens Advice: For tailored advice, visit your local Citizens Advice Bureau. They can provide guidance on local housing developments and any government buying schemes available, such as Help to Buy or Shared Ownership, that might suit your budget.

- Use Property Portals: Websites like Rightmove, Zoopla, and local estate agents’ websites can be invaluable resources. Filter your search for ‘new builds’ or ‘new construction’ to find the latest listings.

How to Book Viewings

Before diving into the search for the best mortgage rates, it’s essential to familiarize yourself with the types of mortgages available. For new-build homes, some popular options include:

- Fixed-Rate Mortgages: These mortgages have an interest rate that remains constant throughout the term, providing stability and predictability in your monthly payments. This can be an attractive option if you prefer to budget without surprises.

- Tracker Mortgages: Tracker mortgages follow the Bank of England’s base rate plus a set percentage. While they can offer lower rates initially, they fluctuate with the market, which means your payments could increase if interest rates rise.

- Help to Buy Schemes: For new-build properties, schemes like Help to Buy can offer equity loans to help with the purchase, reducing the amount you need to borrow from a mortgage lender. Be sure to check the eligibility criteria and terms before applying.

Knowing which mortgage type suits your financial situation and preferences can help you narrow down your options and focus your search for the best rates.

What to Look Out For

- Quality of Construction: Inspect the quality of the construction and finishes. Look out for any signs of rushed work or substandard materials, as this can impact the long-term durability of your new home.

- Energy Efficiency: New build homes are typically more energy-efficient than older homes, which can lead to lower energy bills. Check for features like double glazing, efficient heating systems, and insulation quality.

- Warranty and Guarantees: Most new builds come with warranties, such as the NHBC 10-year guarantee. Ensure you understand what is covered and for how long, as this can save you from unexpected costs down the line.

- Mortgage in Principle: Before making an offer, it’s advisable to secure a mortgage in principle. This shows developers that you are serious and financially prepared to proceed with the purchase. Consulting with a mortgage lender early in the process can streamline your buying journey.

- Consider the Location and Community: Assess the location of the new build within the development. Proximity to amenities, green spaces, and transportation links can significantly impact your daily life and property value.

- Costs Beyond the Purchase Price: Be aware of additional costs such as service charges, ground rent, or contributions to communal areas. These can add up and need to be factored into your budget.

Understanding the Buying Process

- Set Your Move-In Date: Once your offer is accepted and contracts are exchanged, you’ll receive a more concrete move-in date. Be prepared for possible delays in construction, but keep in close communication with your developer.

- Reserve Your Home: Once you find the right property, you’ll typically need to pay a reservation fee to secure it. This fee is usually deducted from the total price upon completion.

- Solicitor and Legal Checks: Hire a solicitor who is experienced in new build transactions to handle the legal aspects, such as reviewing contracts, checking planning permissions, and ensuring all necessary searches are completed.

How to get a good mortage rate

How to get a good mortage rate

Navigating the world of mortgages can be a daunting task, especially when you’re looking to purchase a new-build home. With so many options available, it’s easy to feel overwhelmed by the jargon and endless choices. But don’t worry—finding a good mortgage rate doesn’t have to be a complicated process.

In this guide, we’ll explore some key considerations to keep in mind while you hunt for the best mortgage rates, specifically tailored to new-build homes.

Understand the Different Types of Mortgages Available

Before diving into the search for the best mortgage rates, it’s essential to familiarize yourself with the types of mortgages available. For new-build homes, some popular options include:

- Fixed-Rate Mortgages: These mortgages have an interest rate that remains constant throughout the term, providing stability and predictability in your monthly payments. This can be an attractive option if you prefer to budget without surprises.

- Tracker Mortgages: Tracker mortgages follow the Bank of England’s base rate plus a set percentage. While they can offer lower rates initially, they fluctuate with the market, which means your payments could increase if interest rates rise.

- Help to Buy Schemes: For new-build properties, schemes like Help to Buy can offer equity loans to help with the purchase, reducing the amount you need to borrow from a mortgage lender. Be sure to check the eligibility criteria and terms before applying.

Knowing which mortgage type suits your financial situation and preferences can help you narrow down your options and focus your search for the best rates.

Consider the Advantages of New-Build Homes

New-build homes come with their own set of advantages that can play a role in your mortgage decisions. For instance, many new-builds are more energy-efficient than older properties, which could result in lower utility bills. Additionally, new-build homes often come with warranties and are built to modern standards, reducing the need for costly repairs and maintenance.

These factors can make new-builds an appealing option, potentially influencing your choice of mortgage. Some lenders even offer special rates or incentives for buyers of new-build properties, so it’s worth exploring these options.

Shop Around for Mortgage Deals

Remember, rates aren’t the only factor to consider. Look at the whole package, including arrangement fees, early repayment charges, and the overall mortgage term. Sometimes a lower interest rate might come with higher fees, so weigh the total costs to ensure you’re getting the best deal.

One of the best ways to find a good mortgage rate is to shop around. Don’t just settle for the first offer you receive—different lenders offer different rates and terms, so it’s important to compare. Use mortgage comparison websites, consult with mortgage brokers, and visit your local banks to get a comprehensive view of what’s available.

Improve Your Credit Score

Your credit score plays a significant role in the mortgage rates you’re offered. Lenders use your credit score to assess the risk of lending to you—generally, the higher your score, the better the rates you’ll be eligible for.

To improve your credit score, make sure you’re paying bills on time, keeping credit card balances low, and avoiding too many applications for credit in a short period. Check your credit report for any errors and get them corrected if needed. Even a slight improvement in your credit score could open the door to better mortgage deals.

Get Pre-Approved

Obtaining pre-approval for a mortgage can be a game-changer in your home-buying journey. Pre-approval not only gives you a clear idea of how much you can afford, but it also shows sellers and builders that you’re a serious buyer.

While pre-approval isn’t a guarantee of the final mortgage offer, it can provide a useful benchmark as you continue to shop for the best rates..

Our journey with Toomey Motor Group

Building with Toomey Motor Group

At George Martin Ltd, our mission is twofold: creating exceptional commercial and residential properties and fostering strong, lasting relationships throughout every project. We are known in Essex for our quality, integrity, local focus, and good reputation, making us a trusted name.

We have been able to work on many important projects. Each project has helped us grow and strengthen our values as commercial developers.

This approach has ensured not just customer satisfaction but also sustainable growth for our clients.

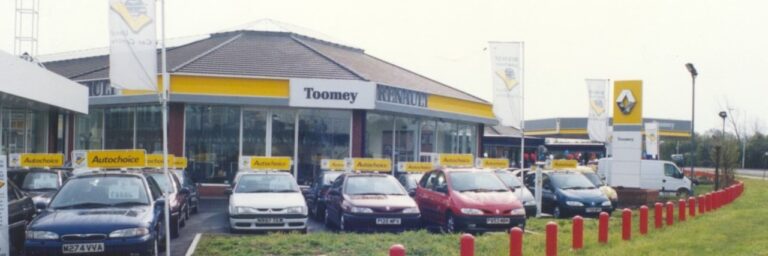

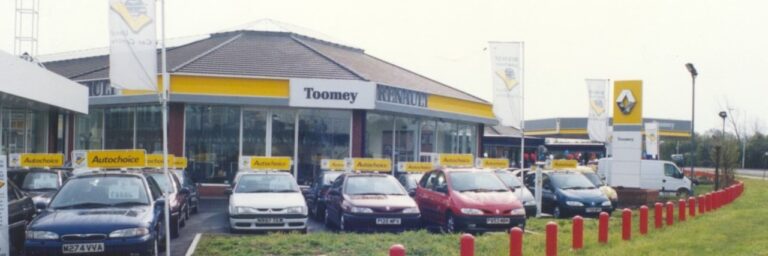

We have worked with Toomey Motor Group since 1962. They are a respected car dealership. They offer 11 reliable car brands. Toomey Motor Group’s presence in Essex is impressive, with sites strategically located in Basildon, Brentwood, and Rochford.

We have worked closely with them for years to improve their presence in these areas by building custom units that meet their specific needs. Our purpose-built structures have become integral to their operations, supporting their long-term success strategy.

The Partnership

We started working with Toomey Motor Group in 1962. Our partnership is based on similar values and both of us succeeding together. One of our first important projects was the Basildon Automotive Retail Park. This project laid the groundwork for our ongoing partnership.

This project aimed to build the headquarters for MJT Securities. It will also include offices for Toomey Motor Group, Unit Export Limited, and Toomey Leasing Group. Our company will have offices there as well.

The development started in 1986 with building Service House and the Toomey Motor Group petrol station. Service House offers 60,000 square feet of space, built for the future to support the Basildon Vauxhall dealerships.

This facility is big and has modern showrooms, workshops, parts storage, staff areas, and offices. These areas are designed to enhance the experience for both employees and customers.

The showrooms and workshops are modern with he parts storage and staff areas alike. The offices are designed to improve the experience for employees and customers. The result has been a high level of customer loyalty and long-term customer relationships that have significantly boosted the sales teams’ performance.

The Following Projects

As Toomey Motor Group continued to grow, so too did our partnership. In response to their expanding needs, we developed a 12-acre site that would become a cornerstone of their business.

In 1995, a major part of the expansion was the construction of the Nissan dealership. This included new showrooms, workshops, and other related spaces. In 1997, Toomey Renault dealership was developed, strengthening our partnership and role in their growth.

Our collaboration didn’t stop there. In 2002, we demolished part of the Vauxhall workshop to build a new Peugeot dealership. This project exemplified the trust and professionalism that have become hallmarks of our relationship with Toomey Motor Group.

We always deliver high-quality work. This has helped us build and keep strong relationships and as a result, our customers have been successful and satisfied over the years.

In 2013, we worked together again to develop the Citroen dealership at their Basildon site. We have made progress in adapting to our clients’ needs. This ensures that every project meets and exceeds their expectations. We use data to make decisions and create spaces that make customers happy and help sales teams succeed.

Developing Relationships

In recent years we have aided Toomey Motor Group in adding more parking, improving landscaping, and introducing Smart Tech in their showrooms.

In 2007-2017 we also took on their Rochford site development. Just a stones throw from the busy town centre the Rochford site houses similar dealerships with the new ode to Hyundai. The 17 acres of land is home to 25,000 square footage of car dealerships, office spaces, petrol stations and KFC.

We continue to form relationships inside the group for our longstanding partnership. Our ongoing development of the Basildon, Rochford and Brentwood site.