Our journey with Toomey Motor Group

Building with Toomey Motor Group

At George Martin Ltd, our mission is twofold: creating exceptional commercial and residential properties and fostering strong, lasting relationships throughout every project. We are known in Essex for our quality, integrity, local focus, and good reputation, making us a trusted name.

We have been able to work on many important projects. Each project has helped us grow and strengthen our values as commercial developers.

This approach has ensured not just customer satisfaction but also sustainable growth for our clients.

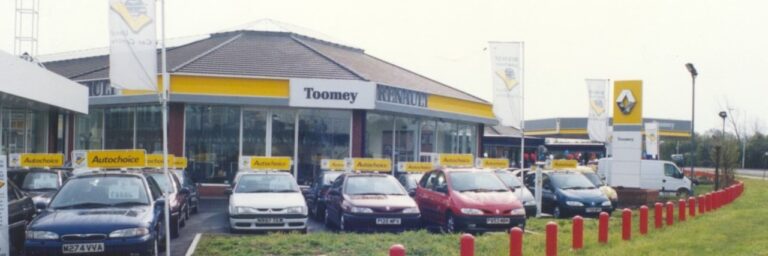

We have worked with Toomey Motor Group since 1962. They are a respected car dealership. They offer 11 reliable car brands. Toomey Motor Group’s presence in Essex is impressive, with sites strategically located in Basildon, Brentwood, and Rochford.

We have worked closely with them for years to improve their presence in these areas by building custom units that meet their specific needs. Our purpose-built structures have become integral to their operations, supporting their long-term success strategy.

The Partnership

We started working with Toomey Motor Group in 1962. Our partnership is based on similar values and both of us succeeding together. One of our first important projects was the Basildon Automotive Retail Park. This project laid the groundwork for our ongoing partnership.

This project aimed to build the headquarters for MJT Securities. It will also include offices for Toomey Motor Group, Unit Export Limited, and Toomey Leasing Group. Our company will have offices there as well.

The development started in 1986 with building Service House and the Toomey Motor Group petrol station. Service House offers 60,000 square feet of space, built for the future to support the Basildon Vauxhall dealerships.

This facility is big and has modern showrooms, workshops, parts storage, staff areas, and offices. These areas are designed to enhance the experience for both employees and customers.

The showrooms and workshops are modern with he parts storage and staff areas alike. The offices are designed to improve the experience for employees and customers. The result has been a high level of customer loyalty and long-term customer relationships that have significantly boosted the sales teams’ performance.

The Following Projects

As Toomey Motor Group continued to grow, so too did our partnership. In response to their expanding needs, we developed a 12-acre site that would become a cornerstone of their business.

In 1995, a major part of the expansion was the construction of the Nissan dealership. This included new showrooms, workshops, and other related spaces. In 1997, Toomey Renault dealership was developed, strengthening our partnership and role in their growth.

Our collaboration didn’t stop there. In 2002, we demolished part of the Vauxhall workshop to build a new Peugeot dealership. This project exemplified the trust and professionalism that have become hallmarks of our relationship with Toomey Motor Group.

We always deliver high-quality work. This has helped us build and keep strong relationships and as a result, our customers have been successful and satisfied over the years.

In 2013, we worked together again to develop the Citroen dealership at their Basildon site. We have made progress in adapting to our clients’ needs. This ensures that every project meets and exceeds their expectations. We use data to make decisions and create spaces that make customers happy and help sales teams succeed.

Developing Relationships

In recent years we have aided Toomey Motor Group in adding more parking, improving landscaping, and introducing Smart Tech in their showrooms.

In 2007-2017 we also took on their Rochford site development. Just a stones throw from the busy town centre the Rochford site houses similar dealerships with the new ode to Hyundai. The 17 acres of land is home to 25,000 square footage of car dealerships, office spaces, petrol stations and KFC.

We continue to form relationships inside the group for our longstanding partnership. Our ongoing development of the Basildon, Rochford and Brentwood site.